Buy to Let

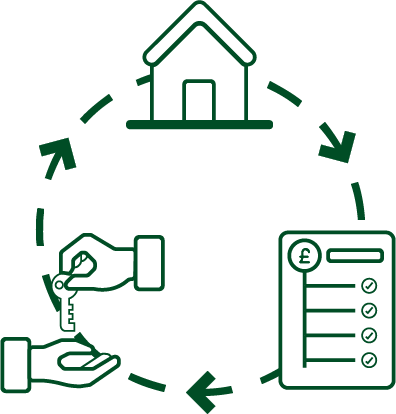

Secure The Right Buy to Let Mortgage For Your Property

With property prices continuing to rise across the UK, investing in a buy-to-let property can seem like an attractive option. But before you take the plunge, it's crucial to understand how buy-to-let mortgages work and what you need to consider.

Some Buy To Let mortgages are not regulated by the Financial Conduct Authority